oklahoma franchise tax return form

The franchise tax is calculated at the rate of 125 for each 100000 of capital employed in or apportioned to Oklahoma. Oklahoma MinimumMaximum Franchise Tax Return A.

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Fill Online Printable Fillable Blank 2021 Form 512 Oklahoma Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma Form.

. Acquired by the nature of all organizations falling within the purview of the Franchise Tax Code. Item B Enter the Account number issued by the Oklahoma Tax Commission beginning with FRX followed by ten digits. The maximum amount of franchise tax that a corporation may pay is 2000000.

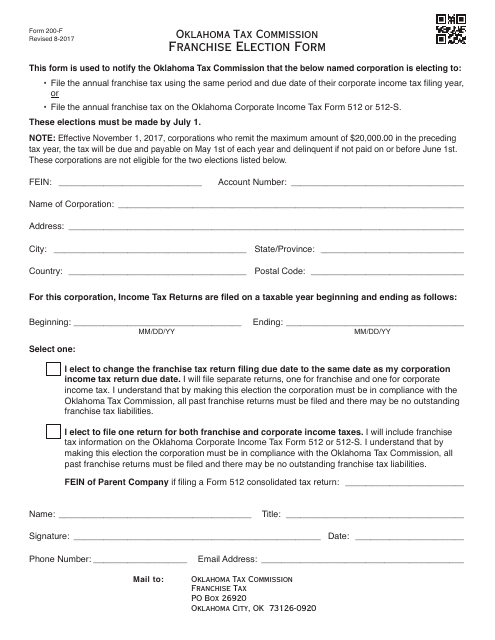

To make this election file Form 200-F. Effective November 1 2017 corporations who remit the maximum amount of 2000000 in the preceding tax year the tax will be due and payable on May 1st of each year and delinquent if not paid on or before June 1st. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Ad Download Or Email OK Form 200 More Fillable Forms Register and Subscribe Now. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. To make this election file Form 200-F.

2018 Form 512 - Page 2. Complete Balance Sheet and Schedules B C D Must be returned with annual return Line 1Line 1 through 3 cash notes accounts receivable and inventories are to be reported at book value. All forms are printable and downloadable.

Once completed you can sign your fillable form or send for signing. Oklahoma Annual Franchise Tax Return State of Oklahoma form is 4 pages long and contains. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Use Fill to complete blank online STATE OF OKLAHOMA OK pdf forms for free. Oklahoma Annual Franchise Tax Return.

When a corporations franchise tax. How is franchise tax calculated. To make this election file Form 200-F.

From income tax return from income tax return Lines. All forms are printable and downloadable. File the annual franchise tax on the Oklahoma Corporate Income Tax Form 512 or 512-S.

15-17 FRX 200 Balance Sheet Oklahoma Annual Franchise Tax Return Page 4 Taxpayer Name FEIN As of the Last Income Tax Year Ended. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Instructions for Completing the MinimumMaximum Franchise Tax Return Who qualifies to File Form 215 Return was due prior to July 1 2006 and your capital is 8000 or less.

NOT complete the franchise tax portion of the return. Complete the applicable income tax schedules on pages 3 4 and 5. Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications Exemption Letters All Taxes Income - Individual Income - Businesses Motor Vehicles Gross Production.

Corporations filing a stand-alone Oklahoma Annual Franchise Tax Return Form 200 or who are not required to file a franchise tax return should. Due Date-Office Use Only- FC. How is franchise tax calculated.

Complete Sections One and Three on pages 1 and 2. Item C Place the beginning and ending reporting period MMDD. The use of the correct corporate name and Federal Employer Identification Number on your return and all correspondence will facilitate processing and handling.

When submitting the Franchise Tax Return foreign corporations must pay a 100 registered agensts fee. Applications for refunds must include copies of your related Oklahoma Income Tax Returns. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200.

Only those corporations with capital of 20100000 or more are required to remit the franchise tax. Oklahoma Annual Franchise Tax Return Instruction Sheet Form 203-A instructions Revised May 1999 First Step. Oklahoma Franchise Tax is due and payable July 1st of each year.

Time for Filing and. Oklahoma Annual Franchise Tax Return State of Oklahoma On average this form takes 62 minutes to complete. If no number has been issued leave blank.

2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma On average this form takes 151 minutes to complete The 2021 Form 512-S Oklahoma Small Business Corporation Income And Franchise Tax Return Packet Instructions State of Oklahoma form is 48 pages long and contains. Fill out and file Schedule A which provides the name and contact information for the businesss officers. Corporations that remitted the maximum amount of franchise tax for the preceding tax year or have had their corporate charter suspended do not qualify to file a combined income and franchise tax return.

These elections must be made by July 1. Prepare and file your Oklahoma Annual Franchise Tax Return and provide the businesss FEIN. Select Popular Legal Forms Packages of Any Category.

Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with. File return payment balance sheet and schedules with the businesss FEIN or EIN. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

MMDDYY This page contains the Balance Sheet which completes Form 200. Returns should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800. All Major Categories Covered.

Once completed you can sign your fillable form or send for signing. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual. To make this election file Form 200-F.

Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now. Complete the Oklahoma Annual Franchise Tax Return Item A Place the taxpayer FEIN in Block A.

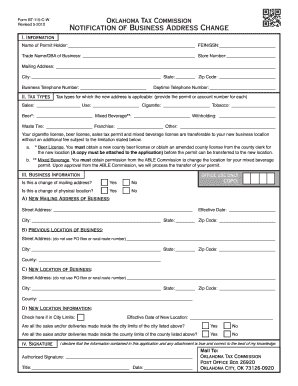

2012 2022 Form Ok Bt 115 C W Fill Online Printable Fillable Blank Pdffiller

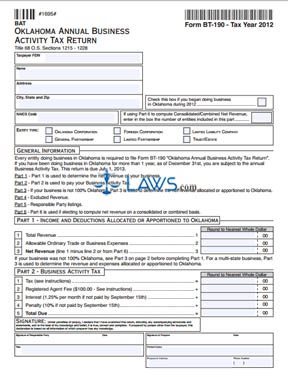

Free Form Bt 190 Oklahoma Annual Business Activity Tax Return Free Legal Forms Laws Com

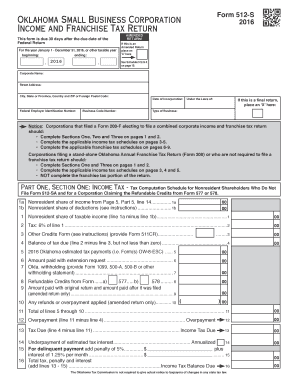

Fillable Online Form 512 S Fax Email Print Pdffiller

Where S My Refund Oklahoma H R Block

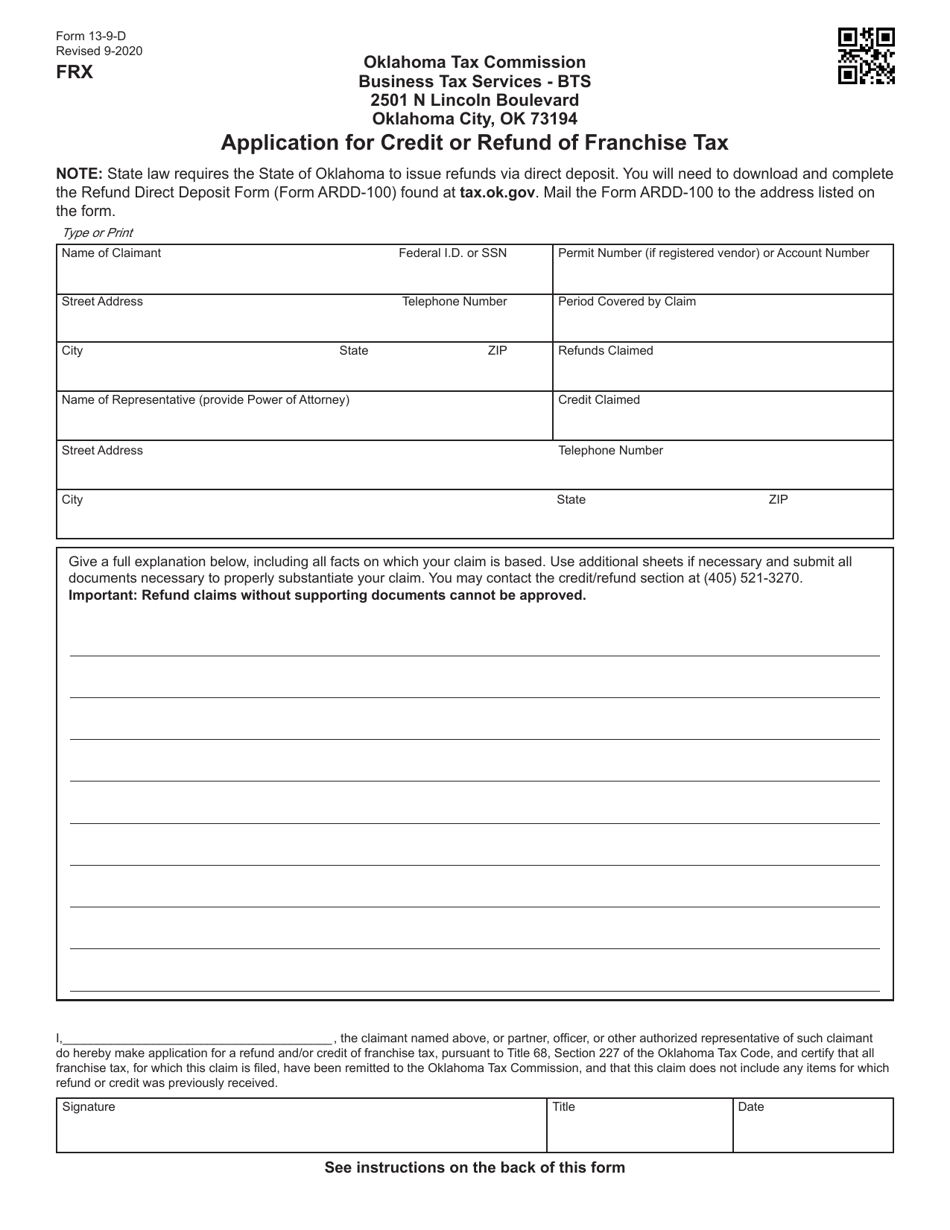

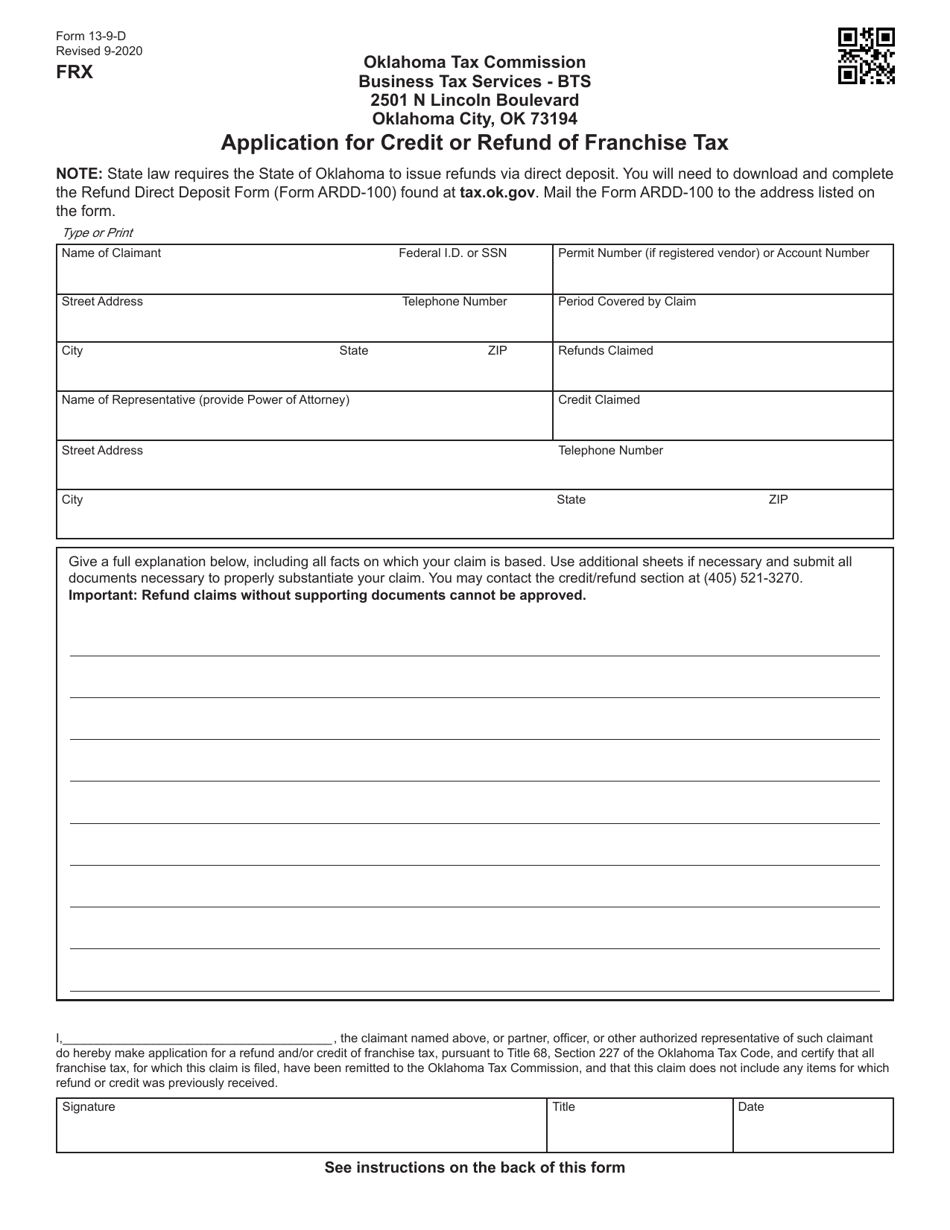

Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

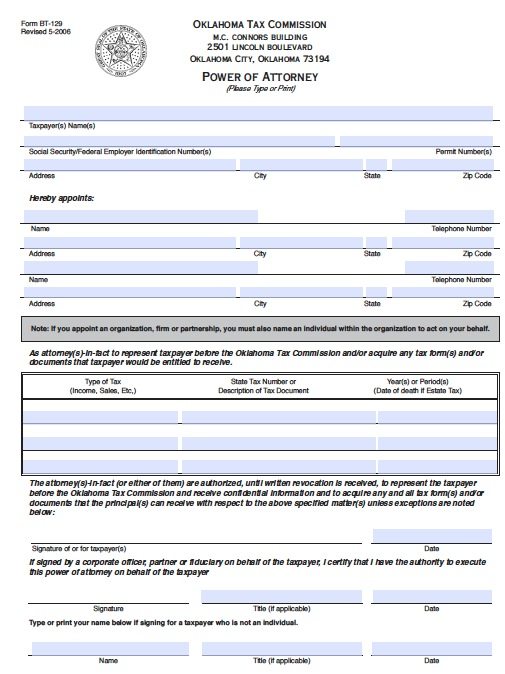

Free Tax Power Of Attorney Oklahoma Form Bt 129 Adobe Pdf

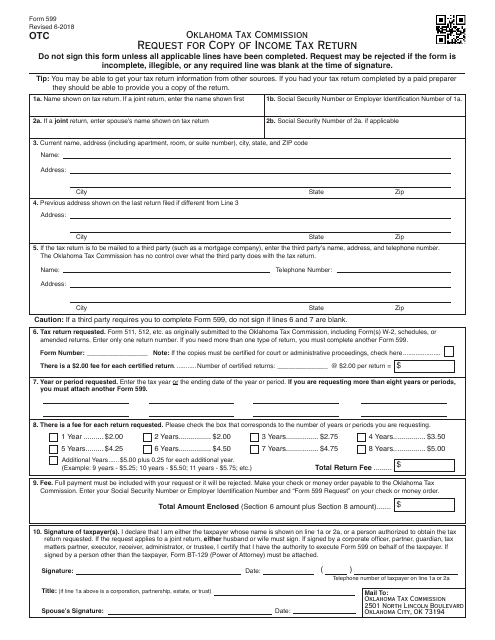

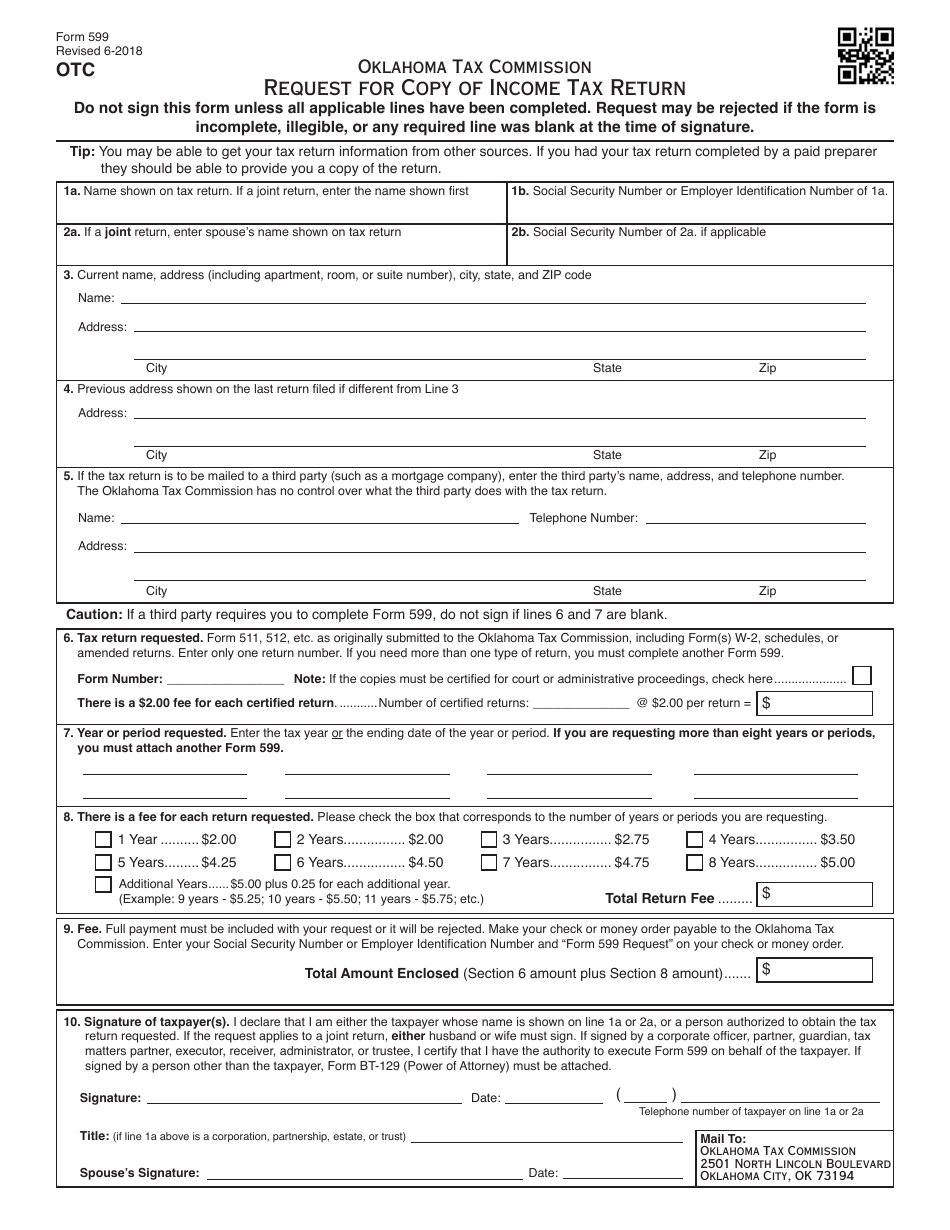

Otc Form 599 Download Fillable Pdf Or Fill Online Request For Copy Of Income Tax Return Oklahoma Templateroller

Otc Form 200 F Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

2021 Form Ok Frx 200 Fill Online Printable Fillable Blank Pdffiller

Otc Form 599 Download Fillable Pdf Or Fill Online Request For Copy Of Income Tax Return Oklahoma Templateroller

2012 2022 Form Ok Bt 115 C W Fill Online Printable Fillable Blank Pdffiller

Otc Form Ef V Download Fillable Pdf Or Fill Online Business Filers Income Tax Payment Voucher For Form 512 512 S 513 513 Nr Or 514 2017 Templateroller

Oklahoma State Tax Information Support

How Failing To File Franchise Tax Returns Causes Personal Liability Texas Tax Talk